ESG and our investment portfolio

Environment Social and Governance (ESG) themes are increasingly important for trustees and members as awareness of how assets can be harnessed for environmental and social good has increased.

Our Responsible Investment Framework sets the basis for managing the risk exposure arising from broader environmental, social and governance risks, including climate change, and is monitored by the Investment Committee. At the broader strategic level, we consider the overall emissions of the portfolio and other metrics, such as the portfolio’s exposure to issuers with science based targets, to monitor the portfolio’s potential future decarbonisation pathway.

We were the first UK insurer to issue a Green bond and the first UK insurer to become a signatory to the United Nations Principles for Responsible Investment as an asset owner. We’re a constituent of the FTSE4Good Index Series, and signatory of the Sustainability Principles Charter (A4S).

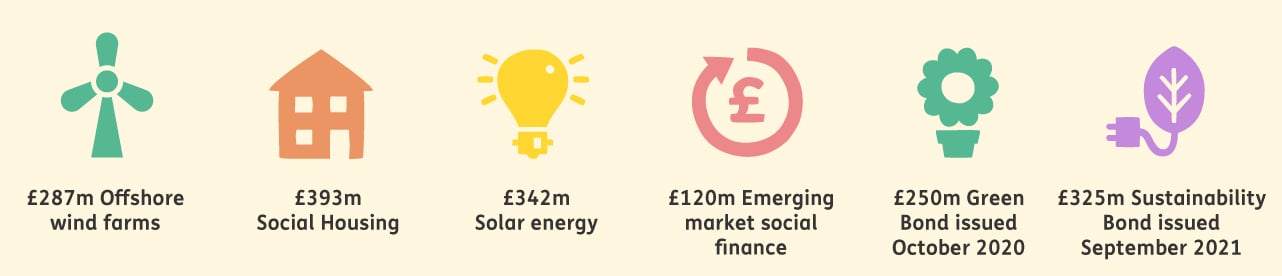

Some notable ESG investments

Values are IFRS valuations at 31 December 2022.

Our approach to asset and liability management

Our investment team are responsible for asset sourcing and investment management. They ensure that cash flows from our asset portfolio are secure, sustainable and sufficient to meet the payment obligations arising from the Group’s wholesale and retail retirement income policies.

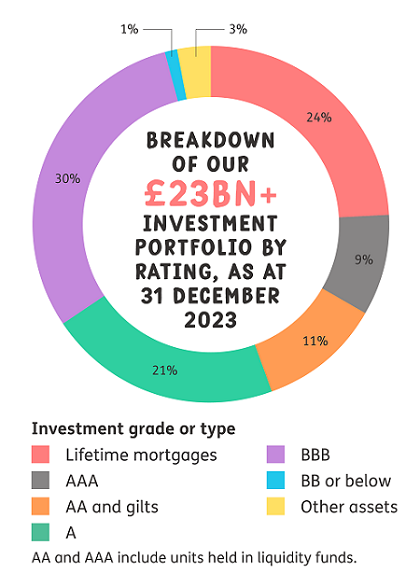

We match the longer duration liabilities with lifetime mortgage loans, infrastructure and other investments and the shorter duration liabilities with bonds and UK sovereign debt. This is a cashflow driven investment strategy.

The investments we hold are invested to ensure the matching of assets to liabilities whilst risks are managed. This helps provides security for trustees choosing to invest in a bulk annuity from Just.